It’s not as crazy as it sounds.

Almost every democratic candidate for president in 2020 wants to raise the federal minimum wage from $7.25/hr to $15/hr. Here in Washington, our state minimum wage is already $12/hr and the sky hasn’t fallen. However, it still means annually someone working full time is only making $24,000/yr (assuming they take 2 weeks off at some point)–hardly a living wage.

What is a living wage?

MIT did a study this year and found that the living wage is $16.54/hr for a family of four, or $68,808/yr. This assumes that two adults are earning the same wage for a single household. Of course, major cities have a significantly higher living wage requirement. For instance, San Francisco’s living wage is over $94,000. But for the sake of argument, let’s skip the metro outliers and focus on a national plan.

The Numbers

With the broad support for a minimum wage increase, I wondered what it would look like if instead of just raising the minimum wage, we gave everyone a decreasing raise by dollar bracket.

So the idea is for every $1/hr someone makes, the percentage of raise they get decreases 5% from the previous bracket. So if someone made $12/hr and got a 50% raise, the $13-$13.99 bracket would get a 47.5% raise, the $14-14.99 bracket would get 45.13%, etc. Around $80-90/hr the raises drop below 1%. Just to avoid getting too into the weeds, we can say the raises stop at $100/hr.

Using Washington’s higher minimum wage, this approach yields pretty good results. The base minimum goes from $24,000/yr to $36,000/yr which, if not living in downtown Seattle, seems like you could live on it just fine. It also means a married couple both working would be guaranteed $72,000/yr instead of $48,000/yr.

However, running the same algorithm with the federal values doesn’t seem impactful enough. The starting value is very low, so even with a 50% raise we end up quite a bit under the current WA minimum wage. The lowest bracket workers would end up earning $43,500/yr as a couple, up from $29,000.

This is still a drastic improvement over the current system. And I feel like it would have more bipartisan support than simply raising the minimum wage. Conservatives view a minimum wage hike similar to a poverty subsidy, since it only applies to those at the very bottom. A pay raise setup in this structure, while similar, affects people who earn up to around $190,000/yr. In this way it will affect the lowest earners up through the middle class.

Under the Washington plan, we actually surpass the living wage mark slightly in the lowest bracket. But with the federal plan, there’s still five pay brackets below the threshold. For jobs that have a built-in overtime mechanic, that wont be a big problem to hit it, but many jobs don’t. So what would it take to get there?

If we want to use the same algorithm for pay increases, we need to start at $11/hr. Then after the raises, we end up at $16.50 for the first bracket. I can’t see congress increasing the wages that much at all once, so maybe we have to settle, for now, on the federal plan above. There will be concerns about a big hike in pay all at once because a lot of companies have come to rely on exploiting the workforce to survive. We also will need time to adapt related legislation, such as assistance programs. Estimating how many people will no longer require SNAP or subsidized housing is tricky since it relies on predicting human behavior as well.

Why is it important?

Studies show that the lowest earners spend almost all their earnings within the local economy. They’re not the ones spending abroad or stashing capital away. Every dollar they earn goes straight back to businesses. Restaurants who are concerned about not being able to pay their wait staff or dishwashers this higher minimum wage will soon see a boon to their clientele, which means more money, which means they can absolutely afford to pay the increased wages.

Taking a look at one study in Kenya where cash was given to impoverished families, we can see how this lifts everyone up.

The researchers identified about 65,000 households across an impoverished, rural area of Kenya and then randomly assigned them to various groups: those who got no help from GiveDirectly and a “treatment group” of about 10,500 families who got a one-time cash grant of about $1,000.

“That’s a really big income transfer,” notes Miguel. “About three-quarters of the income of the [recipient] households for a year on average.” It also represented a flood of cash into the wider communities where they lived. “The cash transfers were something like 17% of total local income — local GDP,” says Miguel.

NPR

Did you catch that? A whopping 75% of their annual income as a lump-sum. Using WA’s minimum wage, that’s equivalent to $18,000. Most of that money went into buying much-needed essentials, but the effect of that was massive. If this were a smaller consistent payment, such as with a wage increase or a universal basic income, it would be a consistent trickle which both citizens and businesses could rely on.

“That money goes to local businesses,” says Miguel. “They sell more. They generate more revenue. And then eventually that gets passed on into labor earnings for their workers.”

The net effect: Every dollar in cash aid increased total economic activity in the area by $2.60.

But were those income gains simply washed out by a corresponding rise in inflation?

“We actually find there’s a little bit of price inflation, but it’s really small,” says Miguel. “It’s much less than 1%.”

Here we see the compounding effect raising the poor has on the economy. The chain reaction it sets off raises the economy 260% from what you put in. Inflation targets set by the fed are around 3%, and lately we’ve been behind that goal, so it would help us there as well.

A Moral Imperative

I could go on and on about how handling people’s basic needs leads to huge improvements to mental health, reduction in crime, higher educational outcomes, more productive workers, greater social engagement, more opportunities for investment, a healthier population, etc. The studies are overwhelming. Take a look for yourself.

One of the major factors in all these improvements is that parts of your brain shut down when in survival mode. Worrying about food or shelter means you literally cannot learn certain things due to human biology. This can trap people into making recurring poor decisions and never escaping the cycle of poverty. Paying a living wage solves a huge portion of society’s woes, and it’s really easy to do!

The Scale

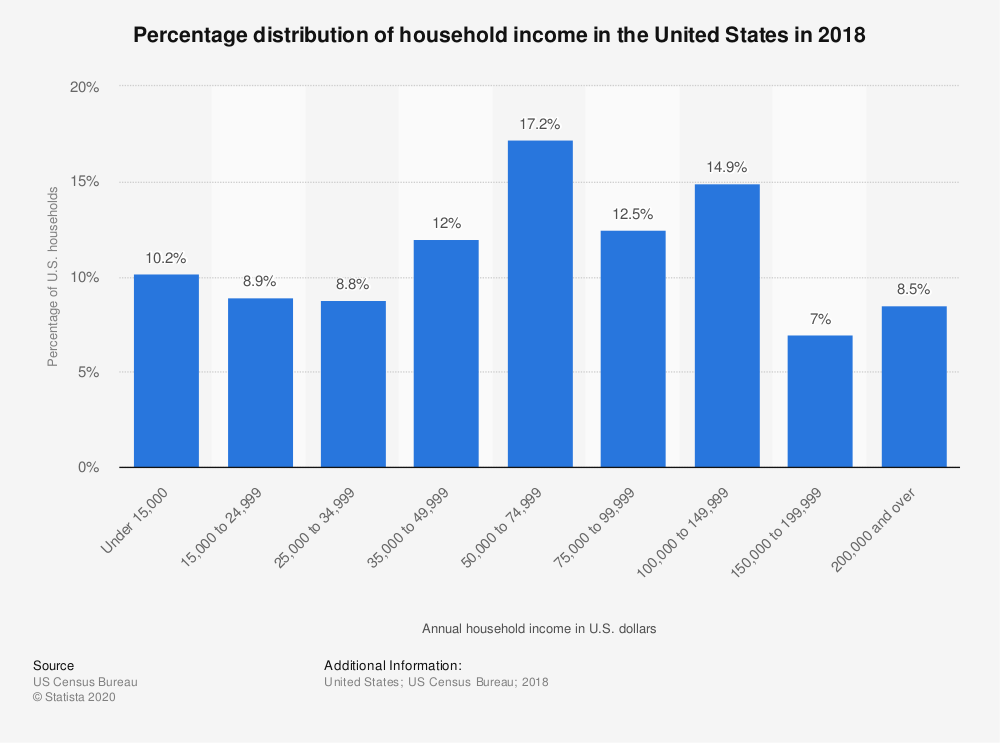

The United States has a lot of poor people. In fact, 40% of all households earn less than $50,000/yr, which is still more than $18,000 under a “living wage.”

There are diminishing returns on how much money you can give someone before it stops coming back into the local economy in significant ways. If we focus on getting people closer to a living wage, even if we don’t commit to bringing everyone there, the economy as a whole will explode. Right now the bottom 50% of the population only holds 1.4% of the nation’s wealth, so it wont take much of our collective wealth to raise them up.

Using the 260% value from before, if we increased the wealth of everyone in the lowest 50% of the population by an average of 30%, that would only cost $450 billion (about the cost of Medicaid), but it would boost the economy by $1170 billion (5.7% of total GDP). Moreover, if you count the boost to the economy as taxable income at around 17%, about $200 billion would actually be raised as taxes. Not to mention sales tax, or the savings from state and federal assistance programs due to people no longer requiring them.

But what about employers?

I hate this question. If an employer is paying minimum wage right now, it usually means their employment is being subsidized. If you make $7.25/hr, you can’t afford rent, food, or heating without assistance. This all comes out of taxes now. This seems like a broken system with a lot of overhead to me. The government has to collect taxes from businesses and citizens in order to fund programs to give that money back to the people who aren’t being paid enough? Please.

If your company can’t survive without paying people a living wage, then it doesn’t deserve to exist. And if it does, it should go through some kind of grant program in order to fairly pay employees. This is also why we specifically need to implement changes on a federal level. An employer in WA is at a disadvantage over other states if they employ minimum wage workers. We don’t want to cause businesses to start hopping state borders due to policy changes, since that too is expensive.

Yes, it will mean some businesses will fail (even if it’s just some). I think we should give employers time to adapt by phasing the program in over a couple of years. We have a lot of ground to make up, but a 50% increase all of a sudden isn’t going to be easy in some sectors. Warn them that it’s coming, and let it hit slowly. If they can’t make changes over a few years, they will go under and leave space for someone else to figure out a better way.